In this digital age, in which screens are the norm yet the appeal of tangible printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or simply adding an extra personal touch to your home, printables for free can be an excellent source. Here, we'll dive to the depths of "Debt Payoff Schedule," exploring their purpose, where they can be found, and what they can do to improve different aspects of your life.

Get Latest Debt Payoff Schedule Below

Debt Payoff Schedule

Debt Payoff Schedule - Debt Payoff Schedule, Loan Payoff Schedule, Debt Repayment Schedule, Debt Payoff Calculator, Debt Payoff Calculator Excel, Debt Payoff Chart, Debt Payoff Calculator With Extra Payments, Debt Payoff Calculator Google Sheets, Debt Payoff Calculator Snowball, Debt Payoff Calculator Spreadsheet

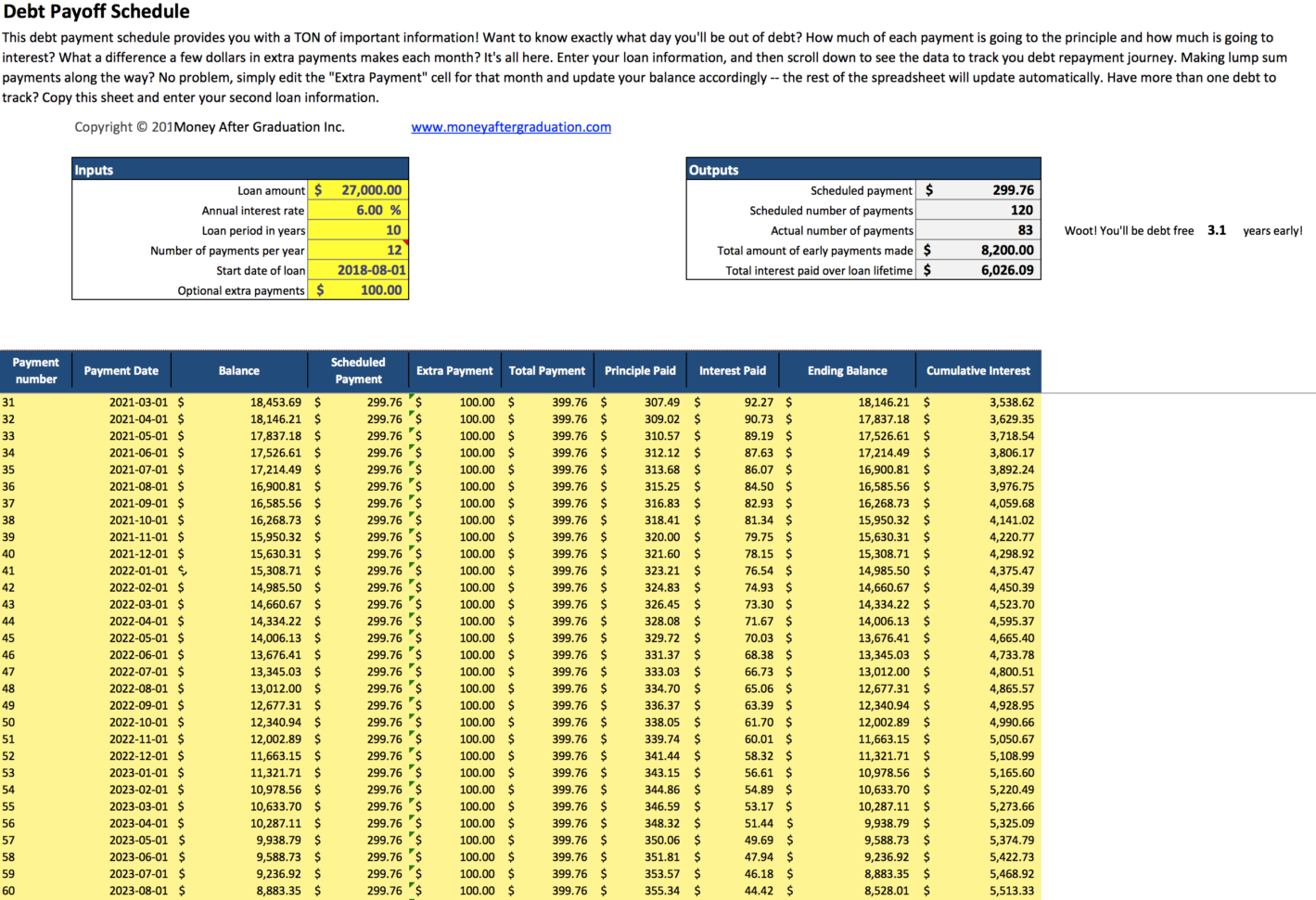

Desired months to pay off Enter the length of time in months that you d like to repay your debt For example if you want to pay off your credit card debt in the next year enter 12 months in this field to estimate how much you need to pay each month to hit that goal

A Debt Schedule is used to keep track of all outstanding debt balances and related payments namely mandatory principal amortization and interest expense Not only does the debt schedule estimate the debt capacity of a company but it can also serve as a tool to anticipate upcoming cash shortfalls that would require additional funding

Debt Payoff Schedule encompass a wide array of printable materials that are accessible online for free cost. These printables come in different kinds, including worksheets templates, coloring pages and much more. One of the advantages of Debt Payoff Schedule is their flexibility and accessibility.

More of Debt Payoff Schedule

Pin On Family

Pin On Family

Easily create a debt reduction schedule based on the popular debt snowball strategy or experiment with your own custom strategy In the first worksheet you enter your creditor information and your total monthly payment You ll then see a summary of when each of the debts will be paid off based on the strategy you choose

Types of Debt Listed in a Debt Schedule To construct a debt schedule analysts need to list all debt currently outstanding by the business The types of debt include Loans Leases Bonds Debentures Factors to Consider in the Construction of a Debt Schedule

Debt Payoff Schedule have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor printed materials to meet your requirements when it comes to designing invitations making your schedule, or decorating your home.

-

Educational Value: The free educational worksheets provide for students of all ages. This makes them an invaluable source for educators and parents.

-

The convenience of Fast access an array of designs and templates reduces time and effort.

Where to Find more Debt Payoff Schedule

Debt Snowball Spreadsheet Moneyspot

Debt Snowball Spreadsheet Moneyspot

Our debt payoff calculator shows you either Time until your debt is paid off or the monthly payments required to payoff debt by a certain date Try it now This debt payoff calculator figures how much you need to pay each month so that your are debt free by any specified date in the future

You can even create a payment schedule and payoff summary Below is more information about the debt snowball plan to help you break free of the debt monster Why Is It Called A Debt Snowball The debt snowball plan is a strategy to pay off debts in order one by one by rolling your payments over like a snowball from one debt to the next

In the event that we've stirred your curiosity about Debt Payoff Schedule Let's find out where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of reasons.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide spectrum of interests, everything from DIY projects to planning a party.

Maximizing Debt Payoff Schedule

Here are some creative ways of making the most of Debt Payoff Schedule:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Debt Payoff Schedule are an abundance of innovative and useful resources for a variety of needs and hobbies. Their availability and versatility make they a beneficial addition to any professional or personal life. Explore the vast collection of Debt Payoff Schedule now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Debt Payoff Schedule really cost-free?

- Yes they are! You can download and print these files for free.

-

Are there any free printables to make commercial products?

- It's contingent upon the specific usage guidelines. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables might have limitations concerning their use. Be sure to read the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home with an printer, or go to any local print store for higher quality prints.

-

What software do I need to open printables free of charge?

- The majority of printables are in PDF format, which can be opened using free software such as Adobe Reader.

Debt Paydown Spreadsheet Google Spreadshee Debt Payoff Spreadsheet

Debt PayOff Schedule 2Page Printable By LemonLime 2Page Debt

Check more sample of Debt Payoff Schedule below

Unavailable Listing On Etsy

Pin By Tammy Lockton On Organizing 2015 Planner Debt Payoff Payoff

Printable The Ultimate Debt Payoff Planner That Will Help You Crush

Free Credit Card Debt Payoff Tracker Printable

![]()

Credit Card Debt Payoff Calculator Spreadsheet Man

Editable Paying Off Debt Worksheets Debt Repayment Budget Template

https://www.wallstreetprep.com/knowledge/debt-schedule

A Debt Schedule is used to keep track of all outstanding debt balances and related payments namely mandatory principal amortization and interest expense Not only does the debt schedule estimate the debt capacity of a company but it can also serve as a tool to anticipate upcoming cash shortfalls that would require additional funding

https://www.financialmentor.com/calculator/debt-reduction

Current Payoff Term The number of months that you are supposed to pay your debts Revised Payoff Term The reduced number of months after calculating based on your revised payment Current Interest Cost The total

A Debt Schedule is used to keep track of all outstanding debt balances and related payments namely mandatory principal amortization and interest expense Not only does the debt schedule estimate the debt capacity of a company but it can also serve as a tool to anticipate upcoming cash shortfalls that would require additional funding

Current Payoff Term The number of months that you are supposed to pay your debts Revised Payoff Term The reduced number of months after calculating based on your revised payment Current Interest Cost The total

Free Credit Card Debt Payoff Tracker Printable

Pin By Tammy Lockton On Organizing 2015 Planner Debt Payoff Payoff

Credit Card Debt Payoff Calculator Spreadsheet Man

Editable Paying Off Debt Worksheets Debt Repayment Budget Template

Printable Debt Payoff Tracker

Free Printable Debt Repayment Plan

Free Printable Debt Repayment Plan

Debt Payoff Worksheet Excel